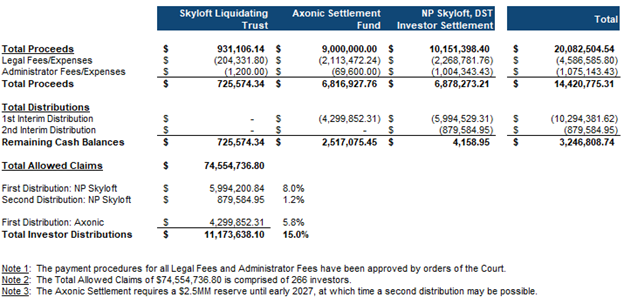

How much have Investors recovered from settlements on account of their NP Skyloft DST investment?

As of June 1, 2025, Investors have recovered a combined total of 15% of their Allowed Claim Amount from two settlement fund sources:

- 5.8% from the Axonic Parties settlement in the May 2025 distribution, and

- 9.2% total from the two Nelson Parties settlement plan distributions, the first one in 2023 totaling 8.0%, and the second one in May 2025 with an additional 1.2%.

Are additional distributions expected?

Yes, although the amount and timing of any additional distribution is currently unknown. There are four potential sources for additional distributions to Investors:

- Axonic Settlement Holdback Funds: The Settlement Administrator is holding back $2.5 million of the Axonic settlement funds as a reserve for certain contingencies until January 2027, which funds may be available for additional distributions in 2027 subject to the Axonic settlement’s court approved terms;

- Nelson Parties Judgment: As previously reported in the Investor Updates, the Nelson Parties defaulted on the prior settlement plan and paid only $9.3 million of the $50 million required settlement amount (only 18.6%) which resulted in a lower recovery to date for Investors. The Plan Administrator initiated legal action against the Nelson Parties and obtained both a judgment and a sanctions award against them for violating the settlement. The Liquidating Trustee’s counsel is pursuing collection of the judgment and sanctions award. Any net recoveries the Liquidating Trustee receives from the Nelson Parties and other litigation targets will be distributed to Investors;

- Other Litigation Targets: The Liquidating Trustee is actively prosecuting litigation against other parties that received funds from the Nelson Parties’ sale of the Sol y Luna property and investigating additional potential causes of action against other parties that may have liability for the Nelson Parties’ violations of the settlement and related Texas court orders; and

- Any Surplus from the Liquidation Trust Administration Funds: The Liquidating Trustee holds approximately $467,000 in net funds received from NP Skyloft DST’s dissolution and $250,000 from the Nelson Parties plan settlement that the Texas court approved to fund the Liquidating Trust’s expenses, including costs for the pursuit of the Nelson Parties judgment and prosecution of related litigation claims. The Liquidating Trustee will distribute to Investors any surplus from these funds after payment of the Liquidating Trust’s expenses.

To ensure you timely receive all future distributions, please report any address changes to the Liquidating Trustee by emailing jason.rudd@wickphillips.com.

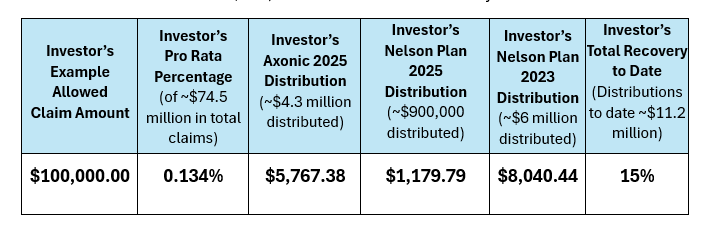

How was the amount Investors received from each distribution calculated?

Each Investor received their pro rata share of the total funds the Texas court authorized for distribution. The pro rata share compares the amount of each single Investor’s Allowed Claim Amount to the approximately $74.5 million in total allowed Investor claims held by all 266 Investors. Here is an example distribution calculation based on an Investor who made a $100,000 cash investment in NP Skyloft DST:

In this example the Investor’s individual $100,000 Allowed Claim Amount is approximately 0.134% of the approximately $74.5 million in total Allowed Claims held by all 266 Investors. As a result, this investor receives a 0.134% share of each distribution. In May 2025, the Settlement Administrator distributed approximately $4.3 million of Axonic Settlement funds and this Investor received approximately 0.134% of that amount, just over $5,767 after accounting for rounding of these approximate amounts.

How is each Investor’s “Allowed Claim Amount” calculated?

Per the rulings of the Texas court, each Investor’s Allowed Claim Amount is the amount of actual cash they invested in NP Skyloft DST (per records provided by the Nelson Parties), without including any interest, profits, bonus, commission, or incentive the Nelson Parties may have promised or provided the Investor.

Is there an accounting of all the Axonic Parties settlement funds and Nelson Parties settlement plan funds and how these funds are used and distributed?

Yes, here is a detailed account as of June 1, 2025: